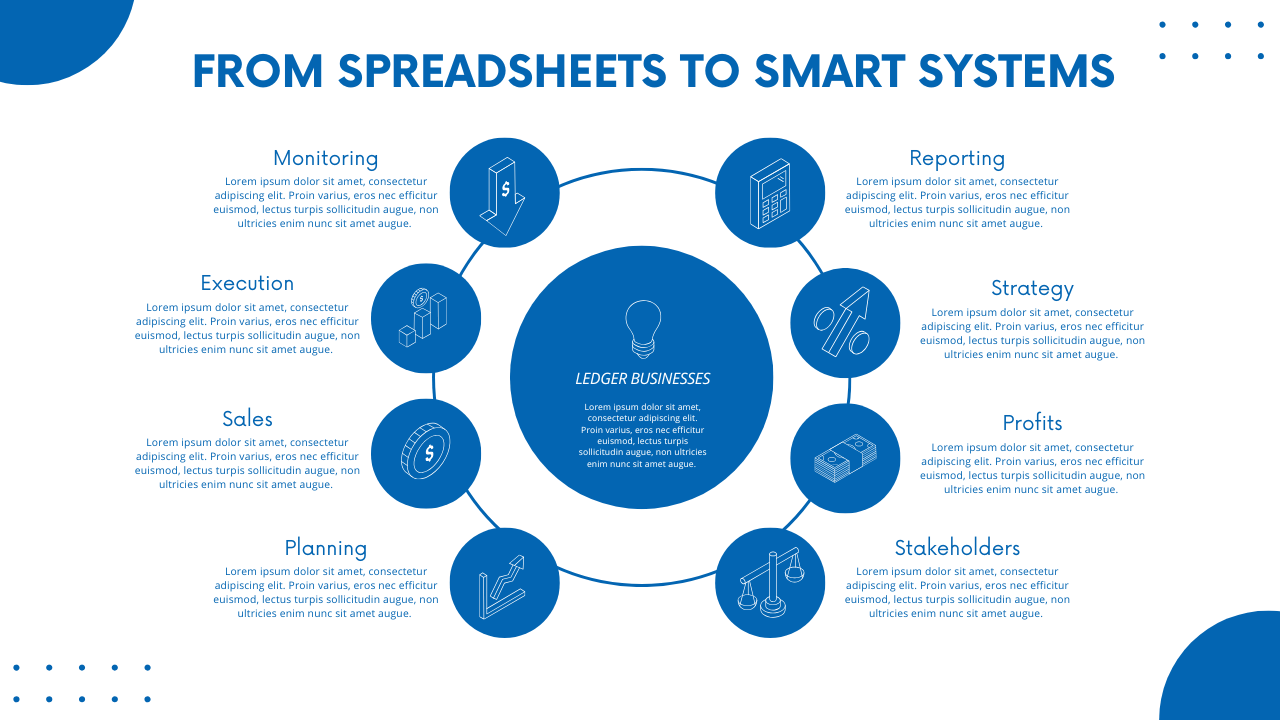

◆ From Spreadsheets to Smart Systems

How modern finance teams are replacing manual chaos with intelligent, automated financial infrastructure.

For decades, spreadsheets have been the backbone of financial operations. They are flexible, accessible, and familiar. Nearly every growing business has relied on them at some stage. But as transaction volumes increase, teams expand, and compliance demands become more complex, spreadsheets begin to reveal their limitations.

The shift from spreadsheets to smart systems is not just a technological upgrade — it is a structural transformation. It represents a move from reactive financial management to intelligent, data-driven operations.

▸ The Spreadsheet Era: Strengths and Limitations

Spreadsheets became popular because they offer customization and control. Early-stage businesses benefit from their simplicity. However, growth exposes structural weaknesses.

| Strengths of Spreadsheets | Limitations at Scale |

|---|---|

| Low cost and easy access | High risk of manual error |

| Flexible formatting | Lack of real-time collaboration control |

| Quick setup | No automated audit trail |

| Custom formulas | Difficult integration with other systems |

| Useful for small datasets | Performance issues with large data volumes |

As businesses scale, the risks of human error, version confusion, and delayed reporting increase. A single incorrect formula can distort financial visibility.

▸ Why Growing Companies Outgrow Spreadsheets

◉ Manual Dependency

Spreadsheets require constant human input. Each new invoice, payroll adjustment, or expense entry must be updated manually. Over time, this creates bottlenecks.

◉ Fragmented Financial Data

When finance data exists across multiple spreadsheets, visibility declines. Leadership may struggle to get a consolidated view of cash flow, liabilities, and profitability.

◉ Compliance Vulnerability

Modern tax and payroll regulations demand accurate audit trails. Spreadsheets lack structured approval workflows and automated compliance safeguards.

▸ The Rise of Smart Financial Systems

Smart systems combine automation, integration, and analytics. These platforms do more than record transactions — they interpret, reconcile, and forecast.

| Feature | Traditional Spreadsheet | Smart Financial System |

|---|---|---|

| Data Entry | Manual | Automated & Integrated |

| Reconciliation | Time-Consuming | Real-Time Matching |

| Reporting | Periodic | Live Dashboards |

| Compliance Tracking | Manual Checks | Automated Alerts |

| Forecasting | Basic Projections | AI-Driven Predictions |

Smart systems allow finance teams to shift focus from data entry to strategic analysis.

▸ Operational Impact of Smart Systems

◉ Faster Month-End Closures

Automated reconciliation and integrated transaction feeds significantly reduce closing time. Reports become available sooner, improving leadership agility.

◉ Improved Accuracy

Machine learning models reduce duplicate entries, flag anomalies, and minimize calculation errors.

◉ Enhanced Cash Flow Visibility

Real-time dashboards provide up-to-date insights into receivables, payables, and liquidity positions.

◉ Stronger Internal Controls

Role-based permissions, automated approvals, and audit logs strengthen financial governance.

▸ Strategic Transformation: From Recording to Predicting

Perhaps the most powerful shift is predictive intelligence. Smart systems analyze historical patterns to forecast future revenue, expenses, and cash gaps.

This enables:

• Scenario planning before major investments

• Risk identification before liquidity shortages

• Data-backed hiring and expansion decisions

▸ Cost vs Long-Term Value

While smart systems require upfront investment, the long-term return often outweighs the cost.

| Short-Term View | Long-Term View |

|---|---|

| Software subscription expense | Reduced manual labor costs |

| Training requirements | Higher reporting accuracy |

| Implementation time | Improved compliance & reduced penalties |

| System transition effort | Scalable growth infrastructure |

What appears as an operational cost often becomes a strategic investment in stability.

▸ Building a Future-Ready Finance Function

The evolution from spreadsheets to smart systems is not about abandoning control. It is about strengthening it.

Modern finance teams require tools that grow alongside the organization. As businesses scale, complexity increases. Automation and intelligent systems ensure that structure keeps pace with ambition.

The future of accounting is not manual and fragmented. It is integrated, intelligent, and predictive. Companies that transition early gain clarity, efficiency, and resilience — while those who delay risk operating with blind spots.

Spreadsheets built the foundation. Smart systems build the future.