◆ Goodbye Manual Reporting, Hello Intelligent Finance.

Why modern businesses are replacing spreadsheets and static reports with automated, real-time financial intelligence.

Manual reporting once defined financial management. Finance teams exported spreadsheets, reconciled numbers by hand, and compiled monthly summaries for leadership review. The process worked — but it was slow, reactive, and prone to error.

Today, intelligent finance systems are reshaping how businesses manage accounting and reporting. Automation, cloud integration, and AI-powered analytics are replacing fragmented workflows. The result is not just faster reporting, but smarter decision-making.

▸ The Limitations of Manual Reporting

Manual financial reporting often creates hidden inefficiencies that compound over time.

| Manual Reporting Challenge | Business Impact |

|---|---|

| Spreadsheet dependency | High risk of human error |

| Delayed month-end closings | Slow strategic decisions |

| Disconnected systems | Inconsistent financial visibility |

| Manual reconciliations | Increased workload & burnout |

| Static reports | No real-time insights |

By the time reports are finalized, the data is already outdated. Leadership teams make decisions based on historical information rather than current realities.

▸ The Shift Toward Intelligent Finance Platforms

Modern cloud-based accounting systems such as :contentReference[oaicite:0]{index=0} and :contentReference[oaicite:1]{index=1} are leading this transformation. These platforms integrate bank feeds, automate reconciliations, and generate dynamic dashboards in real time.

Unlike traditional desktop software or spreadsheet-heavy workflows, intelligent finance platforms centralize financial data into a unified system.

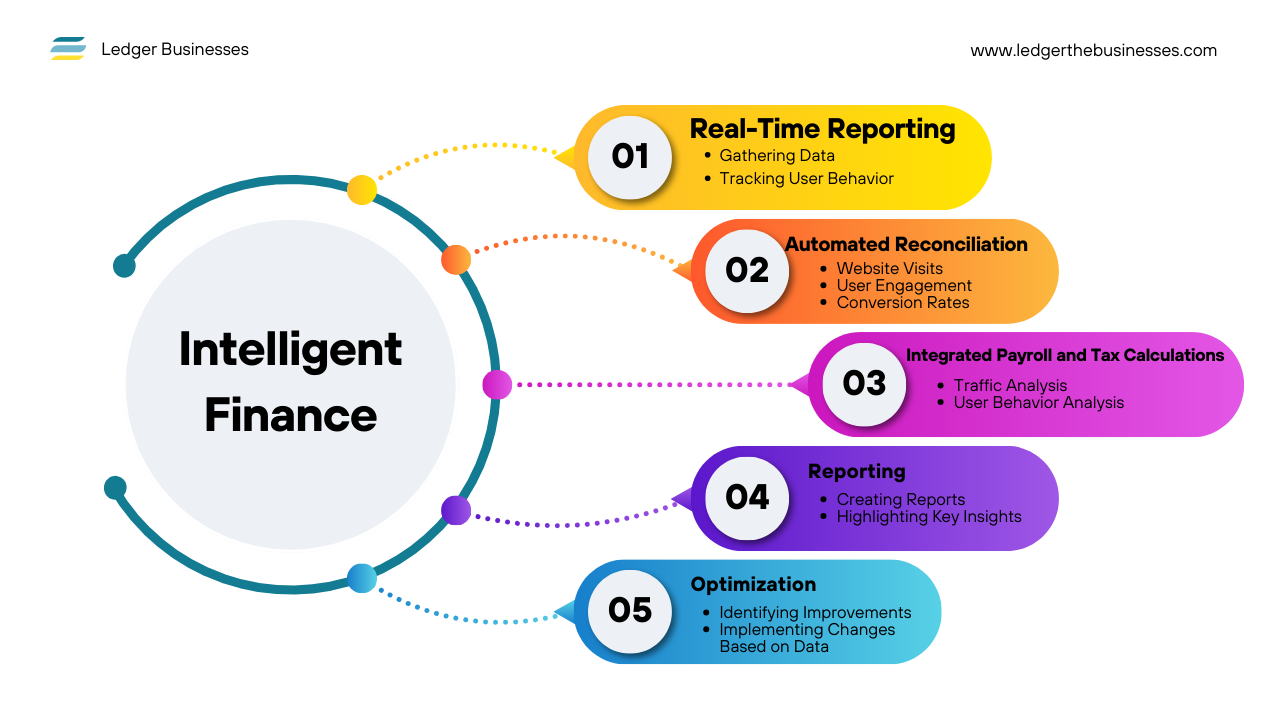

▸ What Intelligent Finance Looks Like

◉ Real-Time Reporting

Instead of waiting for month-end summaries, leaders can access live financial dashboards showing revenue trends, expense patterns, and cash flow positions.

◉ Automated Reconciliation

Bank transactions sync automatically. Systems match invoices and payments instantly, reducing manual intervention.

◉ Integrated Payroll and Tax Calculations

Modern systems integrate payroll modules that automatically calculate tax liabilities, deductions, and compliance reports.

◉ Predictive Forecasting

AI-powered tools analyze historical financial data to forecast revenue and highlight potential liquidity gaps before they occur.

▸ Manual vs Intelligent Finance: A Structural Comparison

| Area | Manual Finance | Intelligent Finance |

|---|---|---|

| Data Entry | Manual & repetitive | Automated & integrated |

| Reporting Speed | Weekly / Monthly | Real-Time |

| Error Detection | Post-review | Automated alerts |

| Forecasting | Basic projections | AI-driven scenario modeling |

| Scalability | Limited by workload | Scales with growth |

▸ Why Alternatives to Traditional Systems Are Gaining Momentum

Businesses increasingly seek flexible, cloud-native solutions that adapt to evolving regulatory and operational demands. Platforms like Xero and QuickBooks provide:

• Secure cloud access from anywhere

• Automated invoice tracking

• Seamless bank integration

• App ecosystems for CRM, payroll, and inventory

• Real-time compliance updates

For growing companies, this integration reduces administrative burden while improving financial clarity.

▸ The Strategic Impact of Intelligent Finance

Financial intelligence extends beyond efficiency. It supports strategic growth.

When leaders have immediate visibility into cash flow and profitability, they can:

• Adjust hiring plans with confidence

• Manage working capital more effectively

• Evaluate investment opportunities accurately

• Reduce financial surprises

Intelligent finance transforms accounting from a reporting function into a decision-making engine.

▸ Long-Term Competitive Advantage

Businesses that cling to manual reporting processes risk falling behind. As markets become more dynamic, agility matters. Real-time insights allow companies to respond quickly to changes in demand, cost structures, and regulatory shifts.

Intelligent finance platforms enable scalable growth while maintaining financial discipline.

The transition from manual reporting to intelligent finance is not simply a technological upgrade. It is a strategic evolution. Companies that embrace it move from reactive reporting to proactive financial leadership — strengthening resilience, efficiency, and long-term competitiveness.