How AI Is Transforming Accounting and Financial Reporting.

Accounting has traditionally been viewed as a precise but time-intensive function. Manual reconciliations, transaction categorization, invoice processing, and month-end closings require accuracy, discipline, and repetition. While digital software improved efficiency over the past two decades, Artificial Intelligence is now reshaping accounting at a structural level.

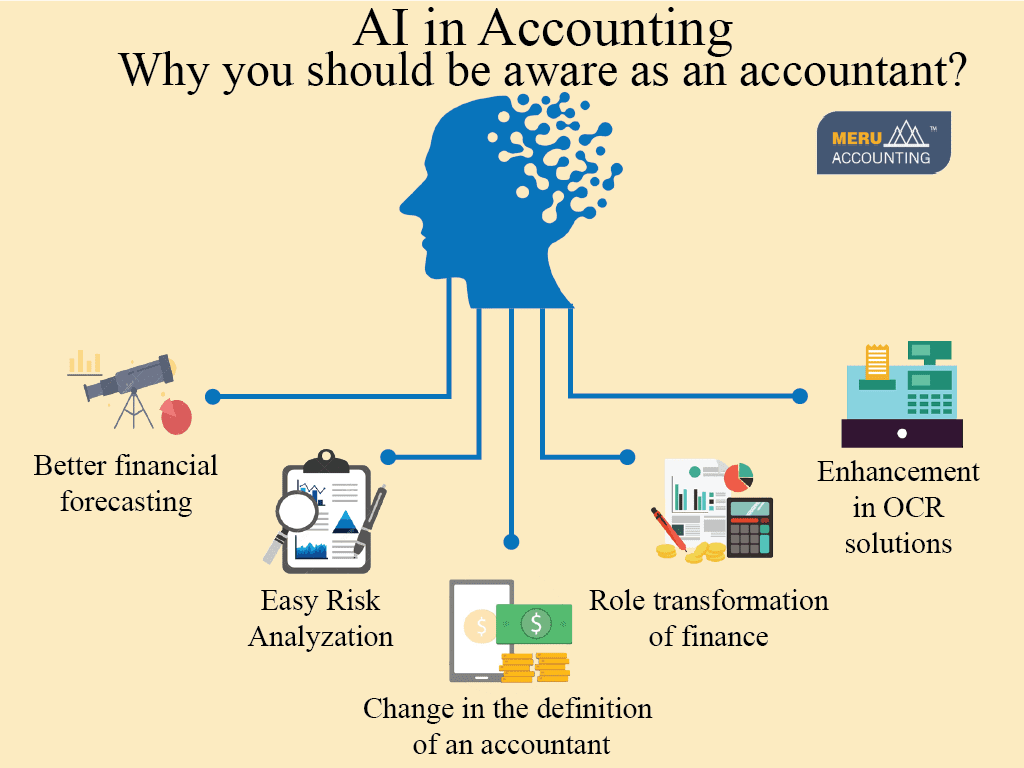

AI is not simply accelerating existing processes. It is redefining how financial data is analyzed, interpreted, and reported. From automation to predictive insights, AI-driven systems are transforming accounting from a historical reporting function into a forward-looking strategic engine.

Automation of Repetitive Financial Tasks

Smart Data Entry and Categorization

AI-powered accounting systems can automatically categorize transactions, match receipts, and allocate expenses with minimal human input. Machine learning models improve over time by recognizing patterns in vendor payments, revenue streams, and recurring entries.

This significantly reduces manual workload and minimizes data entry errors, allowing finance teams to focus on analysis rather than administration.

Automated Reconciliation

Bank reconciliations and ledger matching, once time-consuming tasks, can now be completed in minutes. AI tools identify discrepancies, flag unusual transactions, and suggest corrections automatically.

Faster reconciliation improves reporting accuracy and shortens the month-end closing cycle.

Real-Time Financial Reporting

Traditional accounting often relied on periodic reporting — monthly, quarterly, or annually. AI-driven platforms provide real-time dashboards and dynamic reporting tools that update continuously as transactions occur.

Leaders no longer wait for month-end summaries to assess performance. They gain immediate visibility into cash flow, profitability, expenses, and financial trends. This improves agility and strengthens decision-making.

Predictive Forecasting and Scenario Planning

One of the most transformative aspects of AI in accounting is predictive analytics. By analyzing historical financial data, AI systems can forecast revenue trends, identify seasonal fluctuations, and predict potential cash flow shortfalls.

Scenario modeling allows businesses to test different strategic decisions — such as hiring plans, expansion strategies, or pricing adjustments — before implementation. Financial planning becomes proactive rather than reactive.

Fraud Detection and Risk Management

AI systems can detect anomalies in transaction patterns that may indicate fraud or mismanagement. By continuously monitoring data, machine learning algorithms flag irregular entries, unusual payment patterns, or compliance deviations.

This enhances internal controls and reduces financial risk exposure.

Improved Compliance and Audit Readiness

Regulatory compliance is a growing concern for businesses of all sizes. AI-powered accounting platforms maintain detailed audit trails, automate tax calculations, and ensure reporting accuracy.

By standardizing processes and reducing manual errors, AI enhances audit readiness and minimizes regulatory penalties.

Shifting the Role of Finance Professionals

AI does not replace accountants; it redefines their responsibilities. As automation handles routine tasks, finance professionals shift toward strategic advisory roles.

Accountants increasingly focus on:

Interpreting financial data trends.

Advising leadership on risk management.

Supporting strategic investment decisions.

Enhancing cost optimization strategies.

The role evolves from transactional processing to analytical leadership.

Challenges in AI Implementation

Despite its benefits, AI adoption in accounting requires careful planning. Common challenges include:

Data quality and integration issues.

Cybersecurity concerns.

Initial investment costs.

Employee training and adaptation.

Successful implementation depends on structured data systems and disciplined financial governance.

The Strategic Advantage of AI-Driven Accounting

AI enables finance teams to operate with greater speed, accuracy, and foresight. It reduces administrative friction, enhances reporting transparency, and supports informed decision-making.

Businesses that integrate AI into accounting processes gain a competitive advantage through improved efficiency and strategic clarity. However, the transformation must align with financial discipline and organizational readiness.

Accounting is no longer confined to recording past transactions. With AI, it becomes a real-time, predictive, and strategic function that strengthens long-term financial stability.