◆ The Hidden Cost of Raising Capital Too Early

Why premature funding can quietly weaken focus, discipline, and long-term ownership.

Raising capital is often celebrated as a milestone. Press releases are published, social media posts go live, and momentum appears to accelerate overnight. Funding signals validation, ambition, and external belief in a company’s potential.

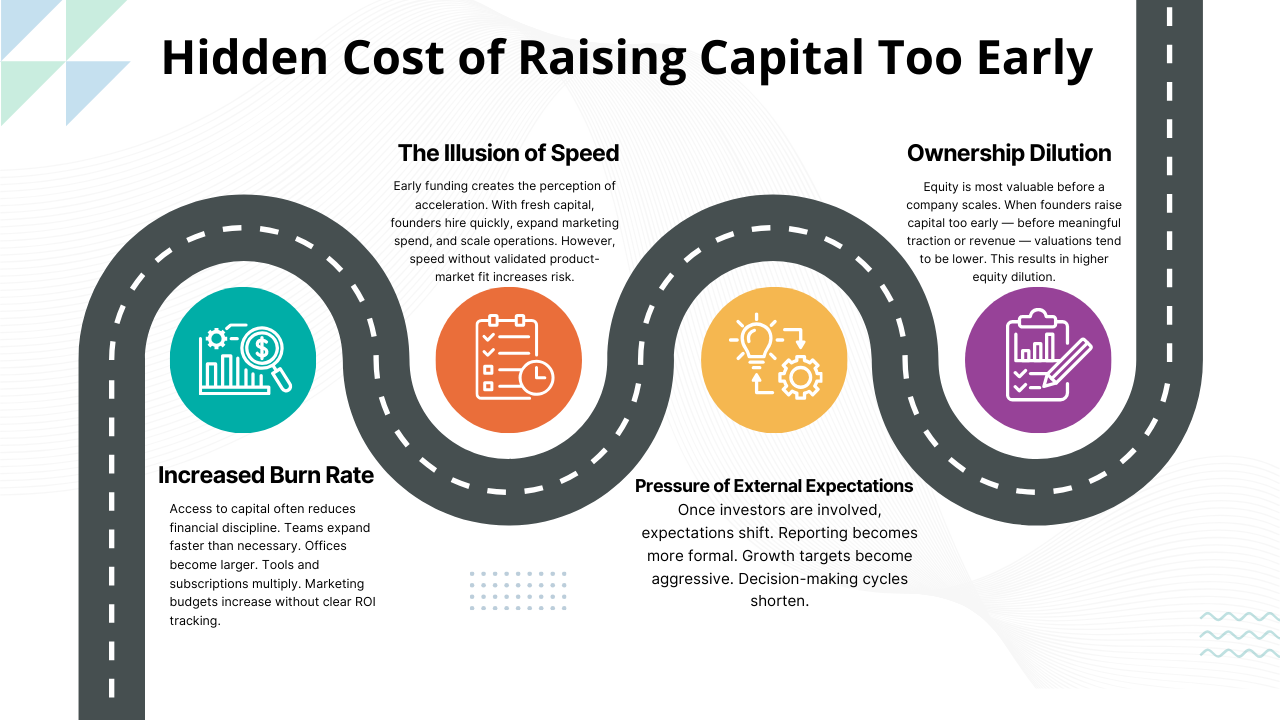

But while capital injection can accelerate growth, raising funds too early introduces hidden costs. These costs are rarely discussed during the excitement of a funding round. They appear later — in diluted ownership, strategic pressure, operational inefficiency, and loss of product focus.

▸ The Illusion of Speed

Early funding creates the perception of acceleration. With fresh capital, founders hire quickly, expand marketing spend, and scale operations. However, speed without validated product-market fit increases risk.

Instead of iterating leanly and refining the core offering, companies may attempt to grow prematurely. Burn rates rise before revenue stabilizes. Expansion becomes expensive experimentation.

▸ Ownership Dilution Before Value Creation

Equity is most valuable before a company scales. When founders raise capital too early — before meaningful traction or revenue — valuations tend to be lower. This results in higher equity dilution.

| Stage | Valuation Strength | Founder Equity Impact |

|---|---|---|

| Pre-Product-Market Fit | Weak | High dilution |

| Early Revenue Validation | Moderate | Balanced dilution |

| Strong Traction & Metrics | Strong | Lower dilution per capital raised |

Capital raised at the wrong stage can permanently reduce long-term ownership and control.

▸ The Pressure of External Expectations

Once investors are involved, expectations shift. Reporting becomes more formal. Growth targets become aggressive. Decision-making cycles shorten.

For founders still refining their product or market positioning, this pressure can distort priorities. Instead of optimizing product quality and customer experience, attention shifts toward meeting growth metrics.

▸ Increased Burn Rate and Operational Inflation

Access to capital often reduces financial discipline. Teams expand faster than necessary. Offices become larger. Tools and subscriptions multiply. Marketing budgets increase without clear ROI tracking.

What was once a lean, focused organization may become structurally expensive.

| Lean Phase | Post-Early Funding Phase |

|---|---|

| Small team, high efficiency | Rapid hiring, layered management |

| Careful spending | Increased fixed costs |

| Founder-led experimentation | Investor-driven performance targets |

When burn rate accelerates before revenue maturity, runway shortens quickly.

▸ Strategic Drift

Early funding sometimes shifts a company’s strategic direction. Investor input may encourage expansion into adjacent markets or faster scaling than originally planned.

While investor insight can be valuable, premature scaling may weaken the core product. Focus becomes fragmented.

▸ Psychological Shifts in Leadership

Capital can subtly alter founder psychology. Confidence increases — sometimes excessively. The urgency to prove growth may override patient product development.

Additionally, dependency on funding cycles can create a pattern of raising capital to solve operational inefficiencies rather than correcting structural issues.

▸ When Early Funding Makes Sense

Early capital is not inherently harmful. It can be powerful when:

• Product-market fit is validated

• Revenue or strong traction metrics exist

• Clear unit economics are defined

• Growth strategy is structured and measurable

• Financial forecasting is disciplined

Capital amplifies strength. It also amplifies weakness. Timing determines which effect dominates.

▸ Long-Term Perspective: Discipline Before Expansion

The most resilient companies often build strong foundations before raising significant external funding. They validate demand, refine operations, and create efficient systems.

When capital enters at the right moment, it accelerates a stable engine rather than compensating for structural gaps.

Raising capital too early is not just a financial decision — it is a strategic commitment. The hidden cost is rarely visible in the funding announcement, but it becomes evident in ownership dilution, growth pressure, and operational complexity.

Capital should fuel clarity, not chaos. Timing is not just important — it is decisive.