◆ Where Automation Meets Financial Strategy

Transforming finance from transactional processing to strategic intelligence through structured automation.

Automation in finance is often misunderstood as a cost-cutting tool. Many businesses initially adopt automation to reduce manual workload, speed up reconciliations, or minimize payroll errors. While these operational benefits are valuable, they represent only the beginning of a much larger transformation.

When automation is aligned with financial strategy, it becomes more than efficiency. It becomes a structural advantage. It connects data, improves forecasting accuracy, strengthens compliance, and enables leadership to make faster, smarter decisions.

▸ The Evolution of Financial Operations

Traditional finance teams focused on recording transactions and producing periodic reports. Modern finance functions operate differently. Automation now bridges operational tasks with strategic planning.

| Traditional Finance | Automated Finance | Strategic Finance |

|---|---|---|

| Manual data entry | Automated transaction capture | Real-time financial visibility |

| Monthly reporting | Continuous reconciliation | Dynamic scenario planning |

| Reactive corrections | Automated error detection | Predictive risk mitigation |

| Historical analysis | Live dashboards | Forward-looking forecasting |

The integration of automation tools shifts the role of finance teams from operational support to strategic advisory.

▸ Automation as a Foundation for Accuracy

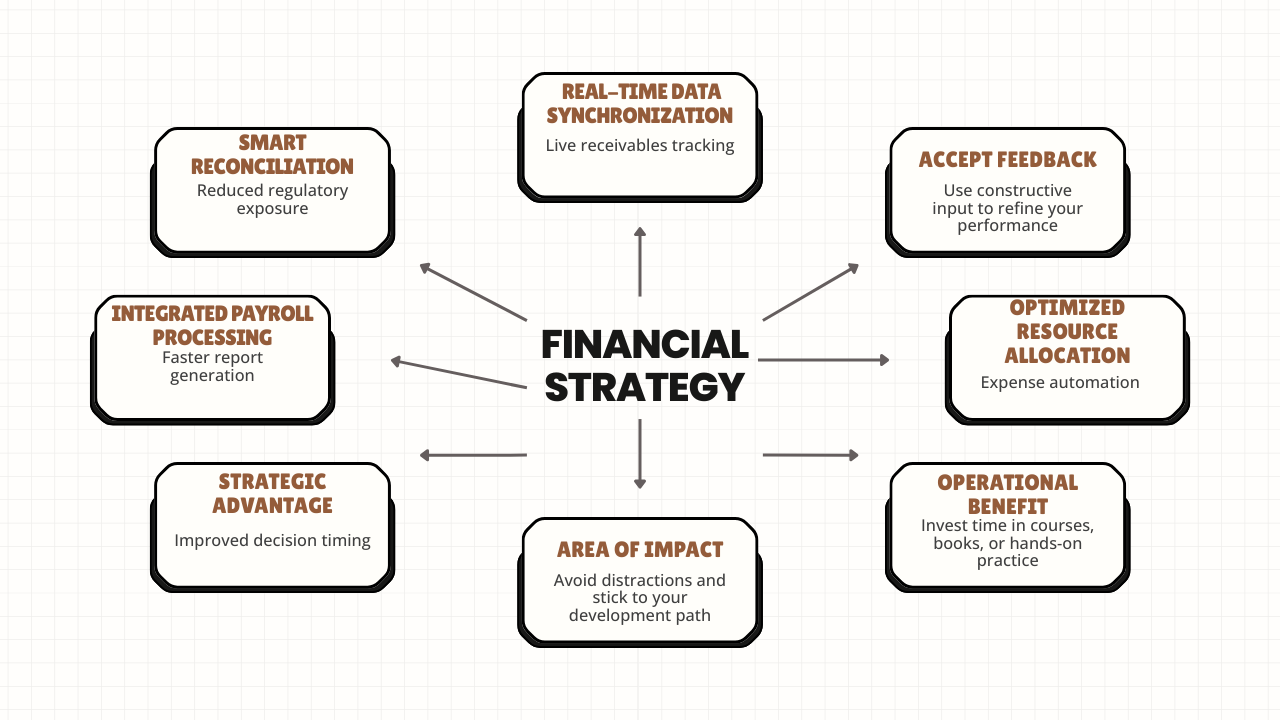

◉ Real-Time Data Synchronization

Modern accounting platforms automatically sync bank feeds, invoices, and payment data. This reduces discrepancies and eliminates repetitive manual updates.

◉ Smart Reconciliation

AI-driven systems detect duplicate transactions, mismatched payments, and anomalies instantly. Errors are flagged before they escalate into financial misstatements.

◉ Integrated Payroll Processing

Automated payroll systems calculate tax liabilities, benefits deductions, and statutory contributions with minimal intervention, reducing compliance risk.

▸ From Efficiency to Strategy

Automation creates space. When finance teams are no longer consumed by administrative tasks, they can focus on strategic analysis.

This shift enables:

• Detailed cash flow modeling

• Investment scenario simulations

• Budget variance analysis

• Working capital optimization

Financial strategy becomes proactive rather than reactive.

▸ The Strategic Benefits of Automation

| Area of Impact | Operational Benefit | Strategic Advantage |

|---|---|---|

| Reporting | Faster report generation | Improved decision timing |

| Compliance | Automated tax calculations | Reduced regulatory exposure |

| Cash Flow | Live receivables tracking | Liquidity forecasting accuracy |

| Cost Control | Expense automation | Optimized resource allocation |

| Risk Management | Anomaly detection | Early financial risk mitigation |

Automation, when integrated strategically, strengthens long-term stability and resilience.

▸ Financial Leadership in the Automated Era

As systems become more intelligent, the expectations of finance leaders evolve. CFOs and financial managers are no longer just controllers of cost. They are architects of growth strategy.

Automation provides accurate, timely data. Strategy interprets and applies that data effectively. The combination allows organizations to expand confidently without compromising financial control.

▸ Avoiding Automation Without Direction

Automation alone does not guarantee strategic advantage. Implementing technology without aligning it to business objectives can create fragmented systems and underutilized tools.

Successful integration requires:

• Clear financial objectives

• Structured data governance

• Defined performance metrics

• Cross-department collaboration

Automation must serve strategy — not replace it.

▸ Building a Future-Ready Financial Infrastructure

The convergence of automation and strategy marks a turning point in financial management. Companies that embed automation thoughtfully create stronger reporting frameworks, clearer forecasting capabilities, and more agile decision-making processes.

Where automation meets financial strategy, finance transforms from a support function into a competitive advantage. Businesses that embrace this alignment gain clarity, speed, and resilience — positioning themselves for sustainable growth in an increasingly data-driven economy.